OECD ➡️ Better Policies for Better Lives on X: 15 actions to put an end to international #tax avoidance #BEPS #OECD / X

BEPS Webcast #4: Presentation of 2014 BEPS Deliverables

OECD releases outcomes of sixth peer review on BEPS Action 13 on country-by-country reporting — Orbitax Tax News & Alerts

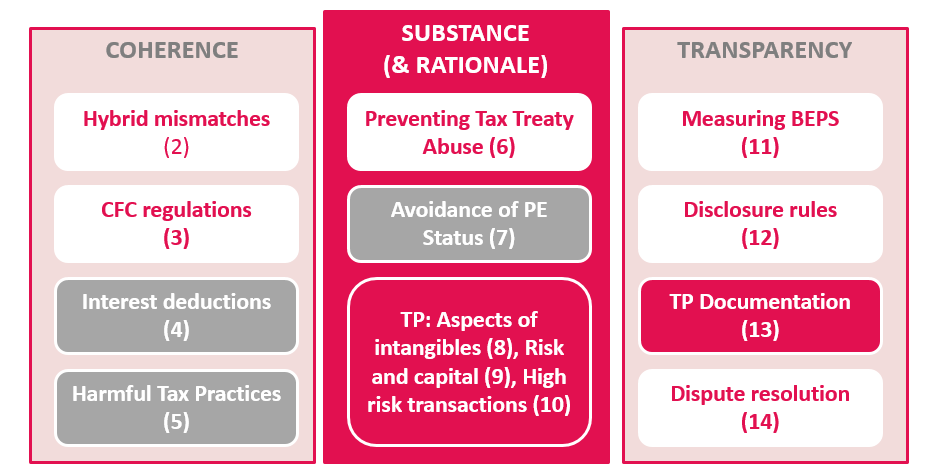

Addressing base erosion and profit shifting (BEPS) is a key priority of governments. In 2013, OECD and G20 countries, working together on an equal

OECD/G20 Base Erosion and Profit Shifting Project Designing Effective Controlled Foreign Company Rules, Action 3 - 2015 Final Report

OECD Releases Strategy for Deepening Developing Country Engagement For BEPS « William Byrnes' Tax, Wealth, and Risk Intelligence

Action 4 - OECD BEPS

Home OECD iLibrary

Addressing base erosion and profit shifting (BEPS) is a key priority of governments. In 2013, OECD and G20 countries, working together on an equal

OECD/G20 Base Erosion and Profit Shifting Project Transfer Pricing Documentation and Country-by-Country Reporting, Action 13 - 2015 Final Report

Tiberghien Economics - BEPS

PDF) Implementing OECD BEPS Action Plan 4 in Indonesia, a comparative study with Malaysia

BEPS Actions Deloitte Netherlands

I.C TP Sources - OECD BEPS Actions 8-10 and 13

Base erosion and profit shifting - OECD BEPS

Overview of the OECD/G20 BEPS Project